You are viewing 1 of your 2 free articles

GCC hotels with cultural focus earn 30% higher room rates

Arthur Little report highlights Saudi Arabia and UAE as regional leaders

Hotels across the Gulf that build culture into their product are now outperforming regional and global competitors on both revenue and guest satisfaction, according to a new cultural hospitality study by consultancy Arthur D Little (ADL).

The report, which positions destinations such as the UAE and Saudi Arabia at the forefront of this shift, argues that in today’s experience‑driven travel landscape, cultural authenticity is fast becoming a baseline expectation rather than a luxury extra, with hotels that embed it across every guest touchpoint seeing clear commercial and reputational gains.

Citing UNWTO figures, the study notes that cultural tourism now accounts for around 40% of global tourism revenues and finds that culturally integrated hotels and resorts in the GCC can command around 30% higher average daily rates and achieve a 5% uplift in occupancy, with Net Promoter Scores reaching up to 83% – well above typical industry ranges.

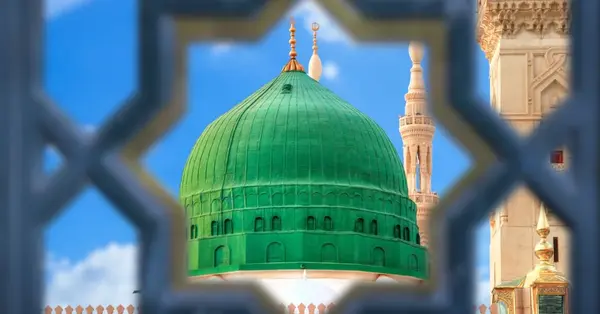

This performance is reinforced by government policy, with the UAE’s Tourism Strategy 2031 and Saudi Arabia’s National Culture Strategy, all hard‑wiring culture into flagship destinations. While, in Oman and Qatar, eco‑cultural lodges, heritage hotel clusters around Souq Waqif and cultural districts such as Katara are giving operators a growing pipeline of partnerships to plug into.

Ichrak Hadj Aissa, Principal at Arthur D Little, says cultural hospitality is no longer a “decorative layer” but a strategic "driver of value”, noting that properties rooted in authentic storytelling and design "command stronger performance metrics across the board".

While five‑star beach and city resorts, heritage hotels and boutique concepts have the most scope to embed culture across design and programming, the report stresses that midscale and budget assets in the GCC can also benefit. Simple measures, such as featuring local crafts in public areas, curating regional music in lobbies, training front‑of‑house teams to share neighbourhood stories or partnering with nearby museums and cultural venues, can deliver a step change in guest perception without major capital expenditure.

RELATED:

GCC inbound visitors want art and culture before beaches and shopping

Prince William visits Saudi Arabia’s cultural tourism hotspots

Hotel review: Bab Samhan, a Luxury Collection Hotel, Diriyah, Saudi Arabia

How GCC operators can embed culture across the stay

For hospitality providers, the report’s central message is that culture must be designed into the entire guest journey, not added at the end as branding. Pre‑arrival, GCC hotels are encouraged to use booking confirmations, pre‑stay emails and social channels to highlight local festivals, heritage districts and contemporary cultural hubs, positioning the property as a gateway to the destination rather than just a place to sleep.

On property, ADL points to vernacular architecture and materials, heritage‑inspired interiors, ceremonial welcome rituals and destination‑driven F&B as critical touchpoints. In practice, this could mean Emirati design cues in a UAE city hotel, Najdi influences in a Riyadh property, as can be seen at Bab Samhan in Diriyah, or menus built around regional dishes with local suppliers.

Programming is another focus area, ranging from collaborations with museums, galleries and cultural institutions to live music and performance nights, literature salons or film screenings showcasing regional talent, and artisans‑in‑residence who demonstrate traditional crafts on site.

Boutique heritage properties such as The Chedi Al Bait in Sharjah are highlighted as examples of how architecture, storytelling and culturally trained hosts can translate national culture agendas into day‑to‑day guest experience.

Post‑stay, the report suggests using follow‑up communications, digital content and curated offers to keep guests connected to the destination’s cultural narrative, supporting repeat visits and word‑of‑mouth referrals. Community‑level initiatives such as fair‑trade sourcing, craft commissions and co‑created events also help owners demonstrate tangible socio‑economic impact, increasingly important for investors.

Biggest returns in heritage, culinary arts and design

For GCC hotels and developers planning their next project or refurbishment, ADL identifies three priority content pillars already delivering results: heritage, culinary arts and architecture and design, offering the “fastest route to differentiation” in a crowded regional pipeline.

However, the report highlights significant headroom in underused sectors including music, fashion and visual arts, with live performances, capsule collections by regional designers, rotating art programmes, literature salons and film nights offering relatively low‑barrier ways to expand cultural touchpoints and attract younger and more experience‑driven segments.

The study’s findings translate into a practical checklist for GCC hospitality stakeholders:

-

Prioritise three or four high‑impact activations – for example, a heritage‑driven F&B concept, a partnership with a local museum and a rotating programme of regional music

-

Train frontline teams to act as cultural storytellers – equipping them with knowledge about neighbourhood history, contemporary culture and upcoming events

-

Build the investment case around ADR and occupancy uplift – using NPS and guest feedback to demonstrate the commercial impact of cultural programming

For more information, visit adlittle.com/en/insights